News, Opinions & Events

One Big Question: What Does ‘Free Market’ Mean? – Oren Cass/Commonplace

“67% of free-market enthusiasts believe free markets should have trade barriers; 61% believe they require strong worker protections.”

“…Americans broadly support ‘free markets,’ which has prompted many political leaders and commentators to assume that they want the laissez-faire agenda promoted by market fundamentalists. Consumers, workers, and businesses are all supposed to protect their own interests by exercising their free choice in the free market. That’s not, it turns out, what most people mean…”

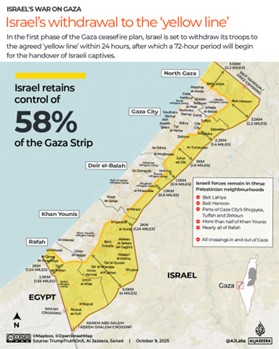

West Bank in the Crosshairs: Updates on Israel’s Increasing Violence – Arab Center

Watch and connect the dots. Why does the US continue to provide billions of $$$ and political support for the Netanyahu government’s ethnic cleansing in the West Bank and Gaza? Could $30 billion be better spent in the US on health care, food, or housing to make life more affordable here?

Stephen Miller’s Hardline Immigration Tactics Are Backfiring – Reason

“Miller says he’s waging a war for America. Americans see a brutal war on them.”

Virginia Democrats propose bills to limit ICE, Republicans question authority – 6 News

In some states, a push to end all property taxes for homeowners – AP

Circuit Breakers Are a Better Option for Property Tax Relief – ITEP

“A circuit breaker is the best form of property tax reduction because it addresses the main flaw of the system: the disconnect between property tax bills and ability to pay. If you lose a job, your income tax payments decrease accordingly – but your property tax bill does not change. Similarly, if you live on a fixed income, your property tax does not stop rising as your home’s value increases…

“A circuit breaker ensures that your property tax bill does not exceed a certain percentage of your income. When that does happen, the circuit breaker refunds you that amount, usually up to a certain cap. Ideally, programs should be open to both homeowners and renters of all ages with benefits and maximum income levels indexed to inflation. But the actual design can be negotiated between legislators and their constituents. This is a fairly popular solution across the country, with 29 states and Washington, D.C. all having some form of a circuit breaker. These programs can help make a state’s overall tax system more equitable…”

Opinion: Parallel universe: Imagine illegal immigrants had killed Alex Pretti and Renee Good – Hill

Voters turn cold on Trump Administration ICE tactics:

Voters Are Split on Deportations but Disapprove of ICE, Poll Finds – NYT

Trump faces fresh MAGA blowback for efforts to ‘de-escalate’ in Minnesota – msn/WaPost

How ’bout that 2nd Amendment?

Trump’s Minneapolis Troubles Are a Sign of Things to Come – Yuval Levin/AEI/National Review

“…But even now, the constraints of the constitutional system already matter a great deal.”

The powerful tools in ICE’s arsenal to track suspects — and protesters – msn/WaPost

State and local reaction:

California Democrats have new plans for confronting ICE: Taxes, lawsuits and location bans – AP

Protesters, Hanover officials oppose proposed ICE facility in Ashland – WRIC/Richmond

Israeli plans for Rafah ‘camp’ in Gaza slammed as continuation of genocide – Al Jazeera

“To analysts in Gaza, no humanitarian intent is behind this projected high-tech infrastructure, which they say is in fact a trap for Palestinians. ‘“What they are building is, in reality, a human-sorting mechanism reminiscent of Nazi-era selection points,’ Wissam Afifa, a Gaza-based political analyst, told Al Jazeera. ‘It is a tool for racial filtering and a continuation of the genocide by other means.'”

Where Trump’s plan to build a ‘New Gaza’ stands – Bloomberg

Trump triggers flight from US dollar – Reuters

De-Dollarization: What Would Happen if the Dollar Lost Reserve Currency Status? – USNWR

“Could countries around the world ditch the dollar in 2026?”

Gold?

Chief economist warns US is nearing ‘financial crisis’ in President Trump’s economy – Fox

New Data Suggests MA Overpayments of $1.2 Trillion Over the Next Decade – CRFB

CMS proposes nearly flat Medicare Advantage payments for 2027: 5 notes – Becker’s Hospital Review

Believe it when you see it…All Medicare rates need to be held near flat for many years so that the country can afford other needs and begin paying down its massive debt.

Time will tell whether the US government and Congress can negotiate on equal footing with the medical-industrial complex ($$$$$$). >>> “There’s many a slip ‘twixt the cup and the lip.” – unnamed lobbyist

It seems the US is not a command economy, says Jim Cramer – CNBC

He talked to Dr. Oz.

Slowdown Season: States Enter Fiscal Year 2027 Budget Battles – Tax Policy Center

“States are drafting fiscal year (FY) 2027 budgets in a far tougher economic environment than just a few years ago. After a post‑pandemic revenue surge, growth has slowed sharply and federal policy changes—”especially the One Big Beautiful Bill Act (OBBBA) and tariffs—are reshaping state revenue baselines.

“For many states, the biggest question is whether—and how—to conform to OBBBA’s tax changes or offset its Medicaid and SNAP cuts. Plus, states face a related challenge: Is now the time to redesign tax systems to better manage policy and economic shocks?”

Aging Experience Differs Vastly By Income – Aging in America News

“Upper-income older adults note better physical and mental health and more time spent pursuing hobbies and socializing…”

Makes sense…Related CCSE work:

More $$$ = Longer life

Courts Struggle to Contain ICE – American Prospect

“…All of this will only hearten the resolve of the citizen opposition. It would be splendid if that opposition included the courts. In the meantime, we need to save ourselves.”

“…Melinda French Gates, a philanthropist and one of the richest people in the world, wrote on X on Tuesday: ‘The deaths of Renée Nicole Good and Alex Pretti are unconscionable and weighing heavily on so many of our hearts.’ … ‘No one in the United States should ever have to fear losing their life for taking peaceful, principled action in support of their beliefs,’ she added.

“‘Our country is not our government—our country is us, we the people. For 250 years, we have been bound together by bedrock values, the rule of law, and inalienable rights. There is nothing more American than exercising our rights and holding our government accountable. Our democracy depends on it,’ she wrote.”

Noem in the hot seat after Minneapolis shooting – Politico

More than half of House Democrats back impeachment push against DHS chief Kristi Noem – Fox

Trump tries to reset — again — on affordability – msn/WaPost

“…A new CNN-SSRS poll found that 3 in 10 Americans rate the economy positively, and 55 percent say that Trump’s policies have worsened conditions. Some 64 percent said that he hasn’t done enough to reduce the price of everyday goods and even about half of Republicans say he should be doing more.”

US economy: beneath the bombast – Michael Roberts

“…And there are more hits to come for the majority of American households. Trump’s so-called “big, beautiful” fiscal bill is now in operation. Trump talks of no taxes on tips and other small measures, but the big hits are cuts to corporate profit taxes and cuts to Medicaid and food stamps. The Congressional Budget Office reckons the bill will reduce the incomes of the 40% lowest income Americans, while the top 20% make large gains.”

Alex Pretti’s parents say administration’s claims about their son are “sickening” – CBS

Republicans, Alex Pretti should be your breaking point – USA Today

“Nothing in the multiple videos of the shooting lines up with Trump administration claims. It looks like a pack of poorly trained goons pounced on a legal observer who was holding nothing but a camera.”

Clinton, Obama warn US values, rights at stake after Alex Pretti killing – UPI

Rep. Haley Stevens Cosponsors Bill to Redirect ICE Funding to Local Law Enforcement

Sunday, January 25, 2026

The Radical King, Claudette Colvin, Patriarchy and Economic Justice – LAP

“The 1968 Poor People’s Campaign for living wage jobs, education and health care sought to actualize democratic socialism. As Dr. Cornel West noted in The Radical King, ‘The litmus test for realizing King’s dream was neither a Black face in the White House nor a Black presence on Wall Street. Rather, the fulfillment of his dream was for all poor and working class people to live lives of decency and dignity.'”

Catholicism Has Declined in Latin America Over the Past Decade – Pew

“Growing numbers of Latin Americans are religiously unaffiliated, but belief in God remains high across the region.”

MAP: Minneapolis General Strike Movement Spreads to 300 Cities on Friday – Payday Report

Thousands brave bitter cold to demand ICE leave Minneapolis – Reuters

Now that Democrats control both houses of the legislature and Governor’s mansion, is Virginia next?:

“Virginia Gov. Abigail Spanberger mentioned the ICE activity in her inauguration address Saturday, just before she rescinded an executive order by predecessor Glenn Youngkin that required state police and corrections officers to support ICE and encouraged local law enforcement agencies to participate in immigration enforcement.”

Where Have the ‘Don’t Tread on Me’ Republicans Gone? – Reason

“Many conservatives are embracing big government, from police-state immigration tactics to socialist economic policies.”

Striking Spanish Workers Just Showed That Amazon Is Not Invincible – truthout

“The workers used creative, disruptive tactics to win. Their victory holds lessons for the global labor movement.”

“…The strike was organized and led by a feisty, class-struggle-oriented rank-and-file committee of the Confederación General del Trabajo, or CGT, one of four unions at RMU1. Unlike the ‘exclusive representation’ model of U.S. labor relations, in Spain — as in other European countries — multiple unions can have a presence at the same worksite. Minimum standards are covered by provincial or national sectoral agreements, negotiated by unions and employer groups…”

Not your grandfather’s factory: Why tariffs won’t help Midwest manufacturing – John Austin/Brookings

“…Compared to international economic rivals, U.S. manufacturing is highly competitive and wildly productive. As the Cato Institute reported in 2023, the United States remains a manufacturing powerhouse, second only to China in its share of global manufacturing output, at 15.9%—a number greater than Japan, Germany, and South Korea combined. With its super-sized population, China is today the world’s largest manufacturer, but relative to the U.S., the country’s workforce is much less productive, producing on balance lower-value products. With a value-added of over $141,000 per worker (i.e., what each worker contributes to the ultimate product value when it’s sold), the United States boasts the world’s most productive manufacturing industry, beating second-place South Korea by over $44,000 per worker and China by over $120,000.

“Decades of impressive productivity gains among U.S. manufacturers have translated into a significantly reduced share of workers directly employed in manufacturing—a decline from its peak of 22% in 1979 to 9% in 2019…”

How the middle class was hollowed out from 1979 to 2022, according to new federal data – Fortune

Everybody is talking about affordability – and making the same mistake – Heidi Shierholz/MSNOW

“Affordability depends on both prices and wages. The roots of today’s affordability crisis actually lie not in recent price spikes, but in the long-term suppression of workers’ pay…If pay for typical workers had kept pace with productivity over the past 45 years, their paychecks today would be roughly 40% larger…”

Frustration over US health costs erupts at congressional hearing – msn/WaPost

As Congress systematically cuts Medicaid and ACA coverage, members from both parties give us performative speeches in a hearing room by beating up on overpaid insurance company CEOs. Elected officials should be yelling at a mirror. Congress — whose members gladly accept campaign money from insurance companies — is ultimately responsible for the astronomical cost of health care in the US and failure to cover 9% of the population.

The next Congressional hearing should feature health officials from three of the 21 countries that cover 100% of their people for a fraction of what the US pays. Ask how they do it. To dig deeper, the committee chair could also invite a health expert from Poland, which covers about the same fraction of its population as the US at one-third the cost, and has a similar life expectancy. People in about 50 other countries live longer.

Feet dragging, division and obstruction: What Israel really wants for Gaza – Al Jazeera

“For much of the public, Palestinians remain invisible. ‘They don’t exist. Israel has probably killed more than 100,000, but the majority of Israelis don’t know or care what’s going on the other side of the border. We even dispute there’s a border; it’s just ours,’ Baskin said. ‘We don’t even see it on TV. All they show are old clips on loop. You can find images of Gaza on social media, but you have to go looking for it…Most Israelis don’t.'”

More posts below.

Hundreds of millionaires call for higher taxes on super-rich – Newser

As the 1 percent get richer, the average American can’t catch up – Independent

“The 1 per cent now collectively have $55 trillion, which nearly amounts to the entire wealth of the bottom 90 per cent. The Fed data presents a bleak picture of how unequal wealth distribution has become over time, with average Americans no longer holding the biggest share of the nation’s wealth like they did in the late Eighties. In September 1989, the first year that the Fed offered statistics, the 1 percent owned 22.8 percent of the national wealth, while the bottom 90 percent held 39.2 percent.”

The Netanyahu government’s short- and long-term goals remain the same: 1) Cut down the size of the Palestinian population however politically practicable and 2) take Palestinian land. Since the ceasefire, it has turned down the rate of killing in Gaza while turning up the seizure of West Bank property.

More than half of Canadian Jews oppose settlement expansion in West Bank and Gaza – Haaretz

Why is AIPAC targeting Trump’s ICE funding? – Forward

How would Netanyahu run ICE?

Trump Has Made ICE the Largest Law Enforcement Agency in the Country – truthout

“With Congress-approved funding, ICE detention is expected to triple in size, mirroring the scale of Japanese internment.”

Here’s one way to help reduce immigration enforcement spending:

“The administration is spending billions on mass arrests, deportations, and troop deployment hunting down the little guys in the immigration drama while big guys profiting from illegal labor go about business as usual…”

ICE detains four children from Minnesota school district, including 5-year-old – msn/WaPost

ICE moves to enter homes without warrants signed by a judge – msn/WSJ

“…For decades, immigration officials haven’t had the authority to search a person’s home without a judicial warrant, on the theory that such a move would violate the immigrants’ Fourth Amendment right to protection against unreasonable search and seizure.”

Trump’s “roving patrols” are closing in on Americans – Axios

” A shadow-docket ruling from the Supreme Court last September allowed these immigration check stops to occur when there’s a combination of suspicions — including appearance, language, accent and workplace — in response to litigation from last summer’s Los Angeles immigration raids. But this is not the final ruling in the case and the case continues to be argued through the lower courts.

“Attorney General Pam Bondi celebrated the initial decision, saying it would eliminate ‘judicial micromanagement.’

“‘We should not have to live in a country where the Government can seize anyone who looks Latino, speaks Spanish, and appears to work a low wage job,’ Justice Sonia Sotomayor wrote in a dissent on the ruling.”

To Solve the Affordability Crisis, Start with Better Jobs and Pay – Urban

Don’t forget paid sick days.

Hochul defies Mamdani with new budget featuring tax on Zyn but not the rich – WaExaminer

“The budget proposal is a sizable increase from the $254 billion budget in New York last year. The increase is driven by Hochul’s allocation of $4.5 billion toward the state’s child care programs. The funding includes $210 million to make pre-kindergarten accessible for 4-year-olds statewide. The money will also go toward a new “2-Care” preschool program for all 2-year-olds in New York City. Hochul and Mamdani made a significant announcement together earlier this month about investing government resources in child care programs…”

CCSE work on this issue:

Featured

Thanks to the Richmond Times-Dispatch for publishing this column:

“…It will take some time for the new governor and Democrats running the state legislature to find effective ways to make life in Virginia more affordable. Reducing the tax burden on low-income families should be part of their agenda. Meanwhile, legislators should avoid adding taxes that hit the poor the hardest.”

States Can Push Back Against Reckless Federal Tax Policy. Here’s How. – Governing

Beware of Republicans bearing cash!

Substituting Cash for Health Insurance Can Drive Up Costs, Medical Bankruptcy – Karl Polzer/CCSE

Not! (for now)

Senate GOP health care plan fails on mostly party-line vote – Hill

As suspected, the two health care subsidy votes were performative art organized by Senate leaders setting a high bar (60/100 votes). Clock’s still ticking for millions of Americans needing health insurance they can afford.

Health Care–Related Savings Accounts, Health Care Expenditures, and Tax Expenditures – JAMA

“Conclusions and Relevance: Participation in FSAs is associated with higher health care expenditures and tax expenditures, while HSAs are not associated with reduced expenditures. Tax policy could be better targeted to enhance insurance coverage and health care accessibility.”

Submitted to Finance Committee Hearing: “The Rising Cost of Health Care: Considering Meaningful Solutions for All Americans”

“No matter how many adjustments the government might make, giving people money to leave the risk pool and bargain on their own with the players in health system undermines the basic concept of insurance – which is pooling risk and resources to make hard-to-predict future expenses more affordable.”

“Understanding Inequality” – a seven-part series by CUNY Stone Center on Socio-Economic Inequality scholar Paul Krugman

- Part I: Why Did the Rich Pull Away from the Rest?

- Part II: The Importance of Worker Power

- Part III: A Trumpian Diversion

- Part IV: Oligarchs and the Rise of Mega-Fortunes

- Part V: Predatory Financialization

- Part VI: Wealth and Power

- Part VII: Crypto

At least two think tanks are holding meetings this month on how to address Social Security’s financing shortfall.

Updated Oct. 8, 2025

“This paper presents options – some favored by conservatives, others by progressives – as a framework for negotiating an equitable solution to Social Security’s financing shortfall. Taken together, the changes could generate up to twice as much in savings and revenue as needed to balance Social Security’s books…

“Congress could strike a deal drawing about half the savings needed to fix Social Security through a gradual benefit reduction by changing the formula for determining initial benefit levels while protecting the lowest earners. The rest of the gap could be filled through tax increases. These financing options provide room for targeted benefit improvements to help the lowest income pay their bills and families raise children.”

Thanks to The Hill for running our oped:

Judge says Trump administration ‘used antisemitism as a smokescreen’ against Harvard – USA Today

Trump Administration’s Cuts to Harvard Funding Are Unconstitutional, Judge Rules – msn/WSJ

CCSE correspondence with Harvard President Garber

“Prediction: Harvard University will be teaching students from all over the world long after what remains of Trump and his brain trust rest in silence beneath the ground. BTW, White House staff could benefit from taking free public finance courses at Harvard’s Kennedy School of Government. Harvard has a positive fund balance. The United State government, not so much.”

No peace, no prize. – Karl Polzer

“Republican members of the US Congress, which is financing Israel’s now escalating ethnic cleansing of Gaza, have nominated President Donald Trump for the Nobel Peace Prize. It is hard to fathom the depth and irony of their fawning depravity. The Nobel prize is clearly a trophy that he covets. But shouldn’t a peace prize have something to do with reducing conflict and killing? The US president and Congress, including a majority of Democrats, are doing the opposite of making peace. They are facilitating Israel’s daily, systematic killing, starvation, and displacement of entire populations of Palestinians in Gaza and the West Bank…”

“Economists and business analysts increasingly agree that Trump’s tariffs are raising prices. There is far less awareness that the historic spike in tariffs – coupled with the tax cuts just made permanent by Congress – comprise a major shift in the tax burden. Taken together, these two changes promise to make the US tax system more regressive. In our increasingly unequal country, taxpayers at the bottom of the economic pecking order are taking on proportionally more of the tax burden as the well-off shoulder less…”

New capitalism III: Capital – Branko Milanovic

“Why is capital so concentrated and why so few have it?”

“The new capitalism has even in the rich countries failed to produce what Margaret Thatcher, and Friedrich Hayek before her, called ‘property-owning society’. (For good measure, Thatcher added ‘democracy’ too.) Even when we include income from forced savings that becomes pension wealth, between one-half and almost 90 percent of the population in rich countries are financial-capital destitute. That percentage becomes more than 90, or even more than 95, in less developed countries…”

Related CCSE work:

Half of Americans have no retirement savings — here’s how Congress can look after them …. op-ed

How the U.S. Retirement Saving System Magnifies Inequality – Society of Actuaries

New Capitalism in America: Richest capitalists and richest workers are increasingly the same people – Global Inequality

Branko Milanovic: The World Under Capitalism – Stone Center/Toronto Public Library

Prof. Milanovic discusses two types of capitalism – “liberal capitalism” in the US and “political capitalism” directed by the Chinese Communist Party. Both systems have produced relatively high levels of income inequality.

Comparing United States and China by Economy – Statistics Times

Just-enacted 2025 budget legislation makes Trump’s 2017 tax cuts permanent. Here’s a CCSE presentation from just after Congress passed that bill:

What has changed? Remains the same?

2025 Social Security groundhog day:

US needs $28 trillion more over 75 years to pay promised benefits

“A few months after the Trump Administration chain-sawed Social Security’s leadership and staff, four newly installed senior officials overseeing the program released the annual report on its declining financial condition. This year’s actuarial forecast is a bit gloomier due in large part to a benefit expansion enacted by the previous Congress. However, in the big picture, not much has changed. Social Security’s looming insolvency remains…

“As I have pointed out to the Senate Budget Committee, the process of spending down Social Security reserves already is increasing overall federal spending and pushing up annual deficits. Drawing down reserves in the Social Security trust funds requires the Treasury to sell bonds (or find other sources of revenue) to raise cash to pay the program’s 74 million beneficiaries.

“On pp. 51-52, this year’s report estimates that Social Security will draw down $181 billion from the combined trust funds in 2025 with the amount rising to $405 billion in 2033. As a result, the federal government is gradually moving to finance part of the program’s benefits through newly issued debt substituting for now-insufficient payroll taxes...”

More on these issues can be found in these CCSE articles and testimony:

- Why Social Security’s big benefit cut won’t happen: The U.S. Treasury already is filling its funding gap – statement to U.S. Senate Budget Committee

- A ‘conservative/progressive’ path to Social Security solvency: bend the benefit cost curve, grow revenue, and protect lower earners – statement to Senate Appropriations Committee

- A Widening Gap in Life Expectancy Makes Raising Social Security’s Retirement Age a Particularly Bad Deal for Low-Wage Earners – Society of Actuaries

- Growing inequality has shrunk Social Security’s revenue. Revitalizing its tax base could help restore solvency without cutting benefits.

- Center on Capital & Social Equity work on Social Security and retirement savings (updated January 2025).

OBBBA’s 30-Year Price Tag – CRFB

“The House-passed One Big Beautiful Bill Act (OBBBA) would add $3 trillion to the debt through Fiscal Year (FY) 2034 as written and $5 trillion if made permanent. Over the long run, it would add far more to the debt.”

Trump, Tariffs, and the Economic Outlook – AEI discussion

“Helping young people learn how to save and build up money for college and adult life are worthy goals. But new ‘Trump kids accounts’ embedded in the massive Republican tax and spending bill before the US Senate not only duplicate existing programs. They also would widen financial gaps between families in our already very unequal country. In addition, tax subsidies for money invested in Trump accounts would go mostly to well-off families and push up the national debt…”

Letter to US citizens:

Student expulsions are an attack on all Americans’ freedom of speech

“This is how fascism happens. First, they come for the powerless. In time, they

will come for you.”

“The federal government has had authority since 1986 to criminally prosecute individuals and companies employing workers not legally in the United State, but it has rarely used that authority regardless of the administration in office. A one-year snapshot taken during Trump’s first term found that no company was criminally prosecuted for having workers not authorized to be in the country, a Syracuse University study shows…

“Changing the equation to incentivize employers to help enforce, rather than skirt, the nation’s immigration laws does not mean subjecting them to cruel and unusual punishment. No need to suspend billionaires and entrepreneurs in cages from a tower or use branding irons. It does mean applying and stiffening laws against hiring illegals and tax avoidance. Financial penalties, public shaming, and loss of contracts could be a start. If that isn’t sufficient, start putting law-breaking employers in jail. They are lining their pockets by stealing jobs from American workers, both native born and those immigrating legally.”

Multiple conflicts of interest:

“By directing a high-powered federal agency working to alter the size and nature of the federal workforce, Elon Musk may be jeopardizing the ability of companies he owns and directs, including SpaceX and Tesla, to contract with the federal government.”

Thanks to the Virginian-Pilot for running our op-ed:

Many questions, few answers about exempting tips from taxes – Karl Polzer/Virginian-Pilot

“Gov. Glenn Youngkin’s proposal to exempt tipped income from state taxes — like President-elect Donald Trump’s on a national level — could help some low-wage workers. However, it also poses risks for others and raises complex issues facing scrutiny as the state legislature begins its work…”

To provide access to all readers (the newspaper’s op-eds are gated), below is the original submission including links to sources:

Statement to 11/20/24 US House Appropriations Committee hearing on Social Security:

“As keeper of the federal government’s purse strings, the House Appropriations Committee plays a part in maintaining Social Security’s commitment to American workers, their families, and taxpayers. First, Committee members can weigh in as Congress and the Treasury find hundreds of billions of dollars annually in cash outside the appropriations process to draw down Social Security reserves. The Committee can also help ‘leave room’ in future budgets for revenue increases that might be necessary to keep Social Security solvent as it coordinates with House Ways & Means, Budget, and other Committees on tax and spending issues.”

The next President and Congress will face daunting fiscal issues. In the shadow of historic levels of national debt, lawmakers will be bargaining over trillions of dollars of taxes and spending as they deal with expiration of the Trump tax cuts. On top of that loom major Social Security financing gaps. Paying promised benefits will require the government to raise more than $2 trillion in cash over the next eight years and more than $24 trillion to achieve long-run solvency.

This paper presents policy options – some favored by conservatives, others by progressives – as a framework for negotiating a solution. Taken together, the changes could generate more than twice as much in savings and revenue than needed to balance Social Security’s books.

The nation’s biggest banks in effect have become today’s payday lenders.

Which U.S. Households Have Credit Card Debt? – St. Louis Fed

46% of American households held credit card debt in 2022.

– Expand the child tax credit to help more working-class parents and grandparents raising kids.

– Provide Social Security credit for unpaid work raising young children.

– Update/improve SSI so more people with disabilities can work, save.

– If taxes must go up, hold the working poor harmless.

Click here for longer version including references and related articles.

CCSE work contributes to Congressional hearing on financing Social Security

Center on Capital & Social Equity (CCSE) analysis and advocacy were evidenced during the June 4 House Ways & Means subcommittee on Social Security hearing of the program’s trust fund. Over the past years, CCSE has worked to explore issues affecting low-wage workers and lay groundwork to defend their Social Security benefits when Congress eventually refinances the nation’s most important social program.

It’s Social Security ‘groundhog day’ as trustees repeat annual forecast of declining finances

“…The trustees’ report, however, neglects to mention how Social Security already is impacting the overall federal budget. As pointed out to the Senate Budget Committee, the mechanics of spending down Social Security’s reserves require the Treasury to draw funds from general revenue and issue new debt to the public. As a result, Social Security is gradually and organically moving to paying for current benefits through debt substituting for now-insufficient payroll taxes that it traditionally relies on.”

Missing the obvious: life expectancy in the U.S. is closely related to income – Karl Polzer

“The underlying theory is simple: More income and wealth allow people and governments to support more years of life. Fewer resources put them at a disadvantage. Some politicians who see the connection may be leery of talking about it. Doing so would lead to awkward questions about improving working and living conditions for millions of Americans and dealing with growing economic inequality.

“The strong relationship between income and longevity is clear when comparing states… (E)ight of the nine states with the lowest median household income also are among the bottom nine in longevity. Similar clustering occurs comparing the highest ranked states across the two categories. Seven of the nine states with the highest median household income also are among the top nine in life expectancy.

“Realizing they are rowing in the same economic boat could prompt states to join forces on policy changes, particularly Mississippi, West Virginia, Louisiana, Arkansas, Alabama, New Mexico, Kentucky, Oklahoma, South Carolina, and Tennessee, and others ranking at or near the bottom…

“Presidential candidate and former South Carolina Governor Nikki Haley strongly proposes raising the program’s retirement age on the premise that increased life spans are undermining Social Security’s long-term solvency. If long-held assumptions about longevity were challenged, and potential losses to low-income workers and low-income states caused by raising the eligibility age came to light, would she change her position? Republican candidate Donald Trump, by the way, opposes cuts in Social Security as do most Democrats…”

Thanks to the Washington Examiner for running this op-ed:

Senate minimum wage bills make bipartisan compromise possible – Washington Examiner

For longer version with references, see:

Previous work on this issue:

One way to make living easier in Virginia – letter to WaPost

Yes, raise the minimum wage, but don’t stop there – op-ed

“More Americans are rightly asking if Israel could neutralize Hamas without massive destruction and loss of civilian life. Indiscriminate air attacks by the Netanyahu regime already have killed and injured tens of thousands of Gazans with no end to the violence in sight. To put this in perspective, imagine how Washington, D.C., would look if a foreign government with the power to fence in the District of Columbia dropped a comparable number of bombs here while shutting off access to water and food and destroying most of the capital area’s housing and medical system. UN officials say conditions in Gaza are catastrophic.”

Thanks to the Washington Post for publishing our letter to the editor:

One way to make living easier in Virginia – Karl Polzer/letter to WaPost

“Virginia Gov. Glenn Youngkin (R) told reporters he is ‘concerned about the cost of living in Virginia and we’re continuing to evaluate how best to address that,’ as reported in the Nov. 26 Metro article ‘Budget battle looms in Virginia. Facing a tighter fiscal environment and Democratic control of the legislature, Mr. Youngkin and fellow Republicans could help working families without denting the budget by making an expected Democratic push for a higher minimum wage a bipartisan affair.

“The GOP has been trying to attract more minority and working-class voters. However, party leaders have stopped short of addressing core economic issues, such as supporting higher wages and better benefits, and mainly stress cultural issues…”

Background Information on these issues provided to Virginia legislators

McCarthy & Co. offer themselves up on the cross to help motivate lazy poor people back to work

Work requirements are a policy failure: Why are they still an option? – The Hill

Thanks to the Washington Post for running our letter:

“Letting Americans Down”

“How can House Speaker Kevin McCarthy (R-Calif.), President Biden and Senate leaders claim to represent the working class and poor when Medicaid work requirements are a focal point in the debt ceiling standoff and the Trump-era tax cuts are not? According to the Congressional Budget Office, the work requirements in the Limit, Save, Grow Act would have a tiny impact (about $5.6 billion in fiscal 2025) on the nation’s $31.4 trillion national debt, but they would increase the number of uninsured and state costs and have no effect on hours worked by Medicaid recipients.

“In contrast, ending the Trump-era tax cuts, which disproportionately benefit the wealthy, could put a major dent in the national debt….”

Because most of this site’s readers won’t be able to get through the newspaper’s pay gate, here’s the draft of the letter sent to the Post:

Debt ceiling negotiators focus on a ‘speck’ in benefits for the poor, ignore the ‘logs’ in their own eyes.

“Legislative Choices for Paying Promised Social Security Benefits”

Statement of Karl Polzer, Center on Capital & Social Equity,

U.S. Senate Budget Committee hearing: “Protecting Social

Security for All: Making the Wealthy Pay Their Fair Share”

Has DT crossed the line into delirium tremens?

“It came out of his mouth during a campaign speech last month.”