News, Opinions & Events

Salve Lucrum: The Existential Threat of Greed in US Health Care – Donald Berwick/JAMA

“The grip of financial self-interest in US health care is becoming a stranglehold, with dangerous and pervasive consequences. No sector of US health care is immune from the immoderate pursuit of profit, neither drug companies, nor insurers, nor hospitals, nor investors, nor physician practices…”

People debate whether access to health care is a “right” or just another good or service in the marketplace that should be distributed by ability to pay. Like food, water, and shelter, medical care is a necessity for sustaining life. The US has the resources to provide everyone with necessary medical care and also pay providers fairly. Unchecked greed now drives up costs — and prices out millions of people.

The Drug Price Delusion: Big Pharma can develop new drugs without gouging Americans. – Michael Lind/Commonplace

“As in many other American industries, pharmaceutical firms have shifted their emphasis from production to financialization, using market power to extract rent from patients, insurance companies, businesses, and the government…

“Almost all developed nations other than the United States counteract the monopolistic pricing power of drug companies by using the monopsonistic bargaining power of government agencies to negotiate drug prices…

“The problem of high drug prices stems from a lack of industry-wide federal price regulation which, unlike America’s inadequate system of patchwork bargaining by government agencies, insurance firms, and businesses, can compel the pharma oligopoly to behave more like regulated public utilities which enjoy moderate profits while providing a public service, rather than like “Pharma Bro” Martin Shkreli’s Turing Pharmaceuticals. Bargaining between government and the pharma industry is the cure for what ails both American patients and American democracy today—the toxic combination of raw market power with raw political power.”

Congress and President Trump: Clock’s ticking on exchange coverage

3 things to consider:

- You still have time to prevent millions of Americans from losing health exchange coverage and to begin improving exchange operations. Act now — or after Christmas or in January with an extended enrollment period.

2. What to do:

- Continue current subsidy structure for 1 or 2 years.

- Evaluate raising premiums for higher-income people for 2027 or 2028. (No need to rush: Only 7% of 24 million covered by exchanges are >400% poverty level.)

- Launch immediate, major effort to reduce fraud by agents and brokers, which could render billions of $$ in government savings. Option: Adding small premiums for low-to-middle income people to increase accountability, get rid of “ghost accounts” set up by fraudulent go-betweens.

- Do not make exchange coverage more complex (by adding HSAs, association health plans, “gimmicks”) without thorough evaluation of impact on costs, program operations, and potential to increase fraud.

3. Your failure to act will hurt millions of voters and have major political consequences.

Background/resources:

House won’t vote on ObamaCare amendments after heated committee meeting – Hill

House Republican Health Care Bill Fails to Address Marketplace Affordability – CBPP

Fraud issues:

Fraud in Marketplace Enrollment and Eligibility: Five Things to Know | KFF “To date, allegations of fraud related to Marketplace enrollment have primarily focused not on the actions of consumers, but on agents, brokers, web brokers and/or third parties that assist these entities in generating business.”

ACA subsidy fraud is ‘rampant,’ Republicans say. Some health policy experts disagree – CNBC Anderson on small premiums

GAO report highlights fraud risk around enhanced ACA subsidies – Fierce Healthcare

Op-Ed: A prescription for fraud? GAO finds serious abuses in Obamacare exchanges – NewsBreak – Center Square

Exchange stats:

Health Insurance Exchanges 2025 Open Enrollment Report – CMS

Marketplace Enrollment, 2014-2025 | KFF State Health Facts

Transitions Between Medicaid, CHIP, and Exchange Coverage

Political consequences:

Dear folks representing Texas in Congress:

Affordable Care Act Health Insurance Enrollment by County: See the Impact Across Texas

How ’bout those exchanges?

Texans’ Experiences with Health Care Access and Affordability – Episcopal Health Foundation

“Almost two thirds of Texans say they skipped or postponed some form of medical care in the past year because of cost…

“The poll finds that almost seven out of 10 Texans (68%) say the state is not doing enough to ensure low-income adults can get the health care they need. Most Texans say the state also is not doing enough to help children (57%) get care and half say the state isn’t doing enough to make sure pregnant women access needed care.”

“…wouldn’t such a move be opposed by high earners? The answer isn’t as obvious as you might think, because most workers with earnings above the cap stand to lose more from benefit cuts than from higher taxes. If nothing is done to shore up Social Security’s finances, EPI estimates that 70% of workers aged 32–66 who earned more than the taxable maximum in 2024 would lose more in benefit cuts than they would pay in higher taxes if the cap were scrapped…”

Who Pays Trump Administration’s Tariffs And Who Could Gain From $2,000 Dividend – Tax Policy Center

“TPC’s analysis finds that the impact of the Trump administration’s tariffs on families differs widely depending on their income. Families in the top income quintile will see their 2026 taxes rise by $7,330, on average, due to the Administration’s tariff policies. For those in the top 1 percent, taxes will rise by nearly $40,000. In contrast, the average tax increase will be $400 and $1,610, respectively, for families in the lowest- and middle-income quintiles.

“Although the average tax increases climb substantially with income, lower-income families will owe the government a larger share of their before-tax income. On average, the federal tax rate will rise by 1.9 percentage points for families in the bottom quintile—substantially more than the increase experienced by those in the top 1 percent of the income distribution (Figure 1).”

Kids’ Share: Analyzing Federal Expenditures on Children – Urban

“This series looks comprehensively at trends in federal and state spending and tax expenditures on children—the kids’ share of public spending.

“Children can’t vote and they can’t lobby for public resources, but their well-being and development affect the future economic and social health of the country. Children also can’t work their way out of poverty, so the government has a special calling to protect them. Public investments are used to educate children; promote their health, safety, and well-being; ensure their basic needs are met; and help protect their families from financial hardship. These investments come in the form of direct spending on programs that serve kids and through tax benefits that offer their families financial assistance.”

Hungary’s population decline deepens: what’s behind the decrease? – Daily News Hungary

Europe faces first natural population decline since Black Death – Chosun Biz

“On the 13th, the Washington Post (WP) said that ‘Europe is terrified of population decline,’ noting that European countries are desperately rolling out pronatalist measures, but their limits are clear. The EU total fertility rate stood at 1.38 last year, an all-time low. At the current pace, by 2100 the EU population will contract to about 419.5 million, down by roughly 27.3 million to as many as nearly 100 million from today.”

List of countries by total fertility rate – Wiki

Who will inherit the earth?

Stream-of-consciousness economics:

Everyone is Gambling and No One is Happy: Vibes, AI, open-mouth coughing, and lessons from 40 weeks of travel – Kyla Scanlon

Is high-tech life poorer, dumber, more treacherous?

Senators brace for another possible shutdown in January – Hill

Sen. Bill Cassidy believes deal on ACA health insurance subsidies could happen – UPI

Obamacare expiration will have ‘death spiral’ effect on US healthcare: experts – Guardian

Republicans have spent decades arguing to use “the marketplace” to expand health coverage and control costs. The ACA created a marketplace for health insurance that has grown to serve 24 million Americans. Instead of trying to destroy it, the GOP should work with Democrats to fix and finetune it. Undermining health care exchanges only strengthens the case for the federal government to create universal coverage and keep prices affordable through regulation. This is what other advanced societies do.

Giving people cash to negotiate with insurance companies, hospitals, doctors, and Big Pharma is most likely to produce higher costs, more uninsured or underinsured people, and more medical bankruptcy. Marketplaces need boundaries and management to be effective – especially for medical care and health insurance.

Rank-and-file Republicans feel heat from constituents on health care – Karen Tumulty/msn/WaPost

“The sticker shock will directly affect the tens of millions of Americans who take advantage of the subsidies. Most of them live in Republican-held congressional districts.

“KFF has estimated that the expiration of the subsidies would more than double, on average, what people are paying annually. More than 4 million people would be likely to lose their health insurance entirely over the next decade, according to estimates from the nonpartisan Congressional Budget Office…

“Demonizing everything about ‘Obamacare’ has been a talking point of Republicans since before the Affordable Care Act was passed in 2010. But over the years, the law has actually become popular, with polls showing close to two-thirds of Americans have a favorable view of it. And while Republicans claim the law has fueled soaring health care costs, studies have shown that the overall increase in health care spending as a share of gross domestic product has slowed since its passage.”

Catholics, Trump, and Affordability – Steve Cortes/RealClear Politics

Donald Trump Is Unaffordable – Desmond Lachman/Project Syndicate

“Heading into next year’s US midterm elections, President Donald Trump seems to have an affordability problem. Not only has he singularly failed to deliver on his promise to bring down prices and reduce mortgage rates, but his massive tax cuts, high import tariffs, purge of immigrants, and relentless pressure on the Federal Reserve to cut interest rates have made living in the US even more unaffordable…

“James Carville, President Bill Clinton’s political adviser, famously made the phrase, ‘It’s the economy, stupid,’ the mantra of the 1992 election campaign. Looking ahead to next year’s midterm elections, the economic issue of affordability will be at the top of voters’ minds. Barring an abrupt economic-policy U-turn, the Republicans face dim prospects, and they have only themselves to blame.”

Sunday, December 14, 2025

One in 10 Mamdani voters were also Trump voters, study finds – Independent

Republicans could be in ‘real trouble’ over economy: Gingrich – Newsweek

What Marjorie Taylor Greene’s resignation says about the post-Trump GOP – Philip Bump/MSNOW

“Perhaps the most potent non-Trump faction on the right at the moment is the America Firsters. Greene used the term repeatedly in her resignation statement, referencing the idea that MAGA hasn’t gone far enough in protecting the U.S. and its citizens.

“The emergence of America First as an alternative to MAGA is heavily a function of a tactical error Trump made. Trump has, to a significant extent, neglected his base, choosing to focus much of his attention during his second term on increasing the power of corporations and other wealthy Americans. (When, for example, is the last time he held a rally for his supporters?) A focus on boosting foreign partners, tariff carve-outs for allied businesses and Trump’s embrace of visas for skilled immigrants — not to mention his suggestion that America lacks similarly skilled workers! — have prompted allies (including Greene) to suggest that he’s taken his eye off the ball.”

Violent Saviors: The West’s Conquest of the Rest – Cato book discussion

“In the name of material progress, the West has sought to develop and frequently exploit the less-developed ‘rest.'” William Easterly draws from 400 years of history—ranging from the conquest of the Americas and the Atlantic slave trade to colonization in Asia and Africa and the invention of the Third World—to show how the West has justified different forms of intervention in the societies it has purportedly intended to improve.

His thesis is strong and fits what Israel’s Zionist government is doing today (with US aid) to Palestinians inhabiting the West Bank and Gaza. Note the panelists’ responses to our question (near the end of the event) about whether markets are inherently “moral” or are simply tools that can be used for good or evil purposes.

What next: Praetorian Guard?

National preservation group sues to halt East Wing ballroom construction – Politico

“The National Trust for Historic Preservation argues the Trump administration must seek congressional approval and consult federal commissions and the public before work continues.”

Trump’s obscene symbol of opulence probably won’t last. If one US president has unchecked power to replace part of the White House, so will the next.

Questions for the courts: Could a president raze part or all of the White House and not replace it? Could a president use donated funds to pay for other government property or functions (eg, equipment and pay for a personal security force or military group) without approval of Congress?

Do HSAs and FSAs Actually Save Employees Money? – World at Work

Health Care–Related Savings Accounts, Health Care Expenditures, and Tax Expenditures – JAMA

“Conclusions and Relevance: Participation in FSAs is associated with higher health care expenditures and tax expenditures, while HSAs are not associated with reduced expenditures. Tax policy could be better targeted to enhance insurance coverage and health care accessibility.”

If there is a genocide in Gaza and no one sees it, did it really happen?

Israel denies some U.S. and foreign doctors entry to Gaza – WaPost

“More than 40,000 Palestinians in Gaza are living with life-changing injuries, including wounds that require consistent care and additional surgeries.”

“…Earlier this year, in May 2025, Dr. Sidhwa delivered harrowing testimony of his experience in Gaza to the UN Security Council:”

Tucker Carlson visits Gaza refugees, accuses Israel of murdering children – Middle East Eye

“…it is a bewildering choice, particularly given low- and middle-income taxpayers’ concerns around affordability, to end a popular government-provided program that saves people money by allowing them to file their taxes for free.”

Exclusive: Tax prosecutions plunge as Trump shifts crime-fighting efforts – Reuters

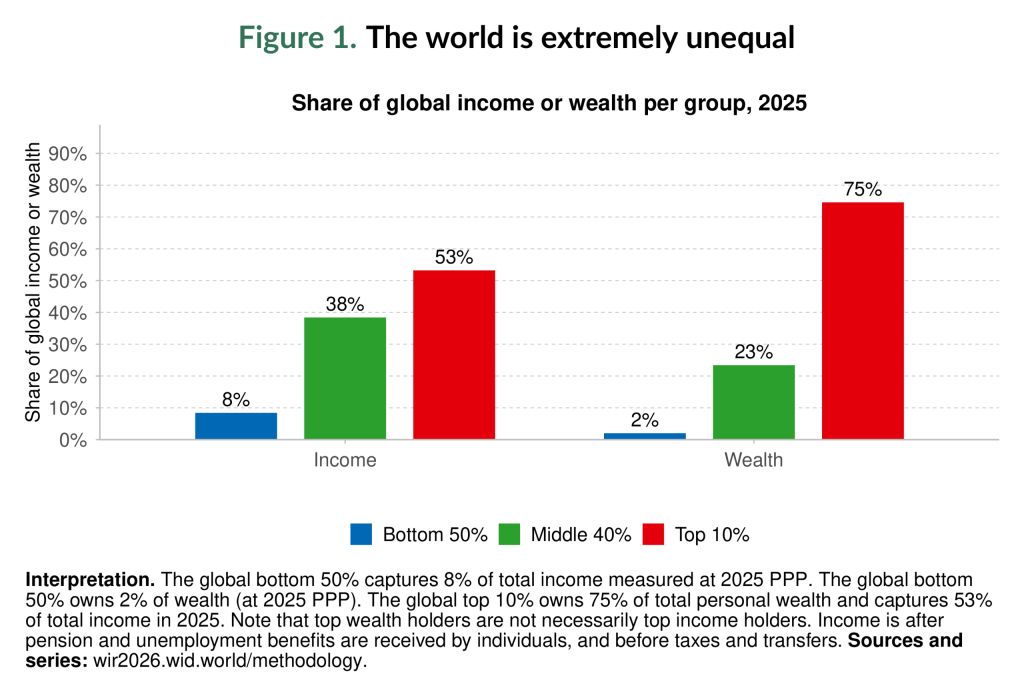

World Inequality Report 2026 – executive summary

“The findings are clear: inequality remains extreme and persistent; it manifests across multiple dimensions that intersect and reinforce one another; and it reshapes democracies, fragmenting coalitions and eroding political consensus. Yet the data also demonstrate that inequality can be reduced. Policies such as redistributive transfers, progressive taxation, investment in human capital, and stronger labor rights have made a difference in some contexts…”

Extreme inequality – and what to do about it – Michael Roberts

“What is missing here? There is no policy to change radically the socio-economic structure of the world economy – in effect, capitalism is to remain. The owners of capital: the banks, the energy companies, the tech media companies, big pharma, and their billionaire owners – all these are not to be taken over. Instead, we must just tax them more and governments must use the tax money to spend on investing in social needs. So the policy is one of redistribution of existing income and wealth inequality, not pre-distribution i.e changing the social structure that engenders these extreme inequalities, namely the private ownership of the means of production…”

How to frame an economic blueprint for the 21st century – Branko Milanovic/China Daily

“During the past several decades the world has undergone a dramatic transformation in the distribution of economic activity, and, less dramatically, in the distribution of political power between countries. The rise of Asia, and China in particular, has shifted the center of economic growth toward East and South Asia. By 2015, the total GDP of China — according to the World Bank’s World Development Indicators (version October 2025), and measured in dollars of equal purchasing power — had overtaken the total GDP of the United States…”

“The Social Security budget includes the suspension of Macron’s unpopular pension changes, which raise the retirement age from 62 to 64, until after the next presidential election in 2027.”

The CCSE analysis below continues getting a high number of hits on this website:

Featured

Beware of Republicans bearing cash!

Substituting Cash for Health Insurance Can Drive Up Costs, Medical Bankruptcy – Karl Polzer/CCSE

Not! (for now)

Senate GOP health care plan fails on mostly party-line vote – Hill

As suspected, the two health care subsidy votes were performative art organized by Senate leaders setting a high bar (60/100 votes). Clock’s still ticking for millions of Americans needing health insurance they can afford.

Health Care–Related Savings Accounts, Health Care Expenditures, and Tax Expenditures – JAMA

“Conclusions and Relevance: Participation in FSAs is associated with higher health care expenditures and tax expenditures, while HSAs are not associated with reduced expenditures. Tax policy could be better targeted to enhance insurance coverage and health care accessibility.”

Submitted to Finance Committee Hearing: “The Rising Cost of Health Care: Considering Meaningful Solutions for All Americans”

“No matter how many adjustments the government might make, giving people money to leave the risk pool and bargain on their own with the players in health system undermines the basic concept of insurance – which is pooling risk and resources to make hard-to-predict future expenses more affordable.”

“Understanding Inequality” – a seven-part series by CUNY Stone Center on Socio-Economic Inequality scholar Paul Krugman

- Part I: Why Did the Rich Pull Away from the Rest?

- Part II: The Importance of Worker Power

- Part III: A Trumpian Diversion

- Part IV: Oligarchs and the Rise of Mega-Fortunes

- Part V: Predatory Financialization

- Part VI: Wealth and Power

- Part VII: Crypto

At least two think tanks are holding meetings this month on how to address Social Security’s financing shortfall.

Updated Oct. 8, 2025

“This paper presents options – some favored by conservatives, others by progressives – as a framework for negotiating an equitable solution to Social Security’s financing shortfall. Taken together, the changes could generate up to twice as much in savings and revenue as needed to balance Social Security’s books…

“Congress could strike a deal drawing about half the savings needed to fix Social Security through a gradual benefit reduction by changing the formula for determining initial benefit levels while protecting the lowest earners. The rest of the gap could be filled through tax increases. These financing options provide room for targeted benefit improvements to help the lowest income pay their bills and families raise children.”

Thanks to The Hill for running our oped:

Judge says Trump administration ‘used antisemitism as a smokescreen’ against Harvard – USA Today

Trump Administration’s Cuts to Harvard Funding Are Unconstitutional, Judge Rules – msn/WSJ

CCSE correspondence with Harvard President Garber

“Prediction: Harvard University will be teaching students from all over the world long after what remains of Trump and his brain trust rest in silence beneath the ground. BTW, White House staff could benefit from taking free public finance courses at Harvard’s Kennedy School of Government. Harvard has a positive fund balance. The United State government, not so much.”

No peace, no prize. – Karl Polzer

“Republican members of the US Congress, which is financing Israel’s now escalating ethnic cleansing of Gaza, have nominated President Donald Trump for the Nobel Peace Prize. It is hard to fathom the depth and irony of their fawning depravity. The Nobel prize is clearly a trophy that he covets. But shouldn’t a peace prize have something to do with reducing conflict and killing? The US president and Congress, including a majority of Democrats, are doing the opposite of making peace. They are facilitating Israel’s daily, systematic killing, starvation, and displacement of entire populations of Palestinians in Gaza and the West Bank…”

“Economists and business analysts increasingly agree that Trump’s tariffs are raising prices. There is far less awareness that the historic spike in tariffs – coupled with the tax cuts just made permanent by Congress – comprise a major shift in the tax burden. Taken together, these two changes promise to make the US tax system more regressive. In our increasingly unequal country, taxpayers at the bottom of the economic pecking order are taking on proportionally more of the tax burden as the well-off shoulder less…”

New capitalism III: Capital – Branko Milanovic

“Why is capital so concentrated and why so few have it?”

“The new capitalism has even in the rich countries failed to produce what Margaret Thatcher, and Friedrich Hayek before her, called ‘property-owning society’. (For good measure, Thatcher added ‘democracy’ too.) Even when we include income from forced savings that becomes pension wealth, between one-half and almost 90 percent of the population in rich countries are financial-capital destitute. That percentage becomes more than 90, or even more than 95, in less developed countries…”

Related CCSE work:

Half of Americans have no retirement savings — here’s how Congress can look after them …. op-ed

How the U.S. Retirement Saving System Magnifies Inequality – Society of Actuaries

New Capitalism in America: Richest capitalists and richest workers are increasingly the same people – Global Inequality

Branko Milanovic: The World Under Capitalism – Stone Center/Toronto Public Library

Prof. Milanovic discusses two types of capitalism – “liberal capitalism” in the US and “political capitalism” directed by the Chinese Communist Party. Both systems have produced relatively high levels of income inequality.

Comparing United States and China by Economy – Statistics Times

Just-enacted 2025 budget legislation makes Trump’s 2017 tax cuts permanent. Here’s a CCSE presentation from just after Congress passed that bill:

What has changed? Remains the same?

2025 Social Security groundhog day:

US needs $28 trillion more over 75 years to pay promised benefits

“A few months after the Trump Administration chain-sawed Social Security’s leadership and staff, four newly installed senior officials overseeing the program released the annual report on its declining financial condition. This year’s actuarial forecast is a bit gloomier due in large part to a benefit expansion enacted by the previous Congress. However, in the big picture, not much has changed. Social Security’s looming insolvency remains…

“As I have pointed out to the Senate Budget Committee, the process of spending down Social Security reserves already is increasing overall federal spending and pushing up annual deficits. Drawing down reserves in the Social Security trust funds requires the Treasury to sell bonds (or find other sources of revenue) to raise cash to pay the program’s 74 million beneficiaries.

“On pp. 51-52, this year’s report estimates that Social Security will draw down $181 billion from the combined trust funds in 2025 with the amount rising to $405 billion in 2033. As a result, the federal government is gradually moving to finance part of the program’s benefits through newly issued debt substituting for now-insufficient payroll taxes...”

More on these issues can be found in these CCSE articles and testimony:

- Why Social Security’s big benefit cut won’t happen: The U.S. Treasury already is filling its funding gap – statement to U.S. Senate Budget Committee

- A ‘conservative/progressive’ path to Social Security solvency: bend the benefit cost curve, grow revenue, and protect lower earners – statement to Senate Appropriations Committee

- A Widening Gap in Life Expectancy Makes Raising Social Security’s Retirement Age a Particularly Bad Deal for Low-Wage Earners – Society of Actuaries

- Growing inequality has shrunk Social Security’s revenue. Revitalizing its tax base could help restore solvency without cutting benefits.

- Center on Capital & Social Equity work on Social Security and retirement savings (updated January 2025).

OBBBA’s 30-Year Price Tag – CRFB

“The House-passed One Big Beautiful Bill Act (OBBBA) would add $3 trillion to the debt through Fiscal Year (FY) 2034 as written and $5 trillion if made permanent. Over the long run, it would add far more to the debt.”

Trump, Tariffs, and the Economic Outlook – AEI discussion

“Helping young people learn how to save and build up money for college and adult life are worthy goals. But new ‘Trump kids accounts’ embedded in the massive Republican tax and spending bill before the US Senate not only duplicate existing programs. They also would widen financial gaps between families in our already very unequal country. In addition, tax subsidies for money invested in Trump accounts would go mostly to well-off families and push up the national debt…”

Letter to US citizens:

Student expulsions are an attack on all Americans’ freedom of speech

“This is how fascism happens. First, they come for the powerless. In time, they

will come for you.”

“The federal government has had authority since 1986 to criminally prosecute individuals and companies employing workers not legally in the United State, but it has rarely used that authority regardless of the administration in office. A one-year snapshot taken during Trump’s first term found that no company was criminally prosecuted for having workers not authorized to be in the country, a Syracuse University study shows…

“Changing the equation to incentivize employers to help enforce, rather than skirt, the nation’s immigration laws does not mean subjecting them to cruel and unusual punishment. No need to suspend billionaires and entrepreneurs in cages from a tower or use branding irons. It does mean applying and stiffening laws against hiring illegals and tax avoidance. Financial penalties, public shaming, and loss of contracts could be a start. If that isn’t sufficient, start putting law-breaking employers in jail. They are lining their pockets by stealing jobs from American workers, both native born and those immigrating legally.”

Multiple conflicts of interest:

“By directing a high-powered federal agency working to alter the size and nature of the federal workforce, Elon Musk may be jeopardizing the ability of companies he owns and directs, including SpaceX and Tesla, to contract with the federal government.”

Thanks to the Virginian-Pilot for running our op-ed:

Many questions, few answers about exempting tips from taxes – Karl Polzer/Virginian-Pilot

“Gov. Glenn Youngkin’s proposal to exempt tipped income from state taxes — like President-elect Donald Trump’s on a national level — could help some low-wage workers. However, it also poses risks for others and raises complex issues facing scrutiny as the state legislature begins its work…”

To provide access to all readers (the newspaper’s op-eds are gated), below is the original submission including links to sources:

Statement to 11/20/24 US House Appropriations Committee hearing on Social Security:

“As keeper of the federal government’s purse strings, the House Appropriations Committee plays a part in maintaining Social Security’s commitment to American workers, their families, and taxpayers. First, Committee members can weigh in as Congress and the Treasury find hundreds of billions of dollars annually in cash outside the appropriations process to draw down Social Security reserves. The Committee can also help ‘leave room’ in future budgets for revenue increases that might be necessary to keep Social Security solvent as it coordinates with House Ways & Means, Budget, and other Committees on tax and spending issues.”

The next President and Congress will face daunting fiscal issues. In the shadow of historic levels of national debt, lawmakers will be bargaining over trillions of dollars of taxes and spending as they deal with expiration of the Trump tax cuts. On top of that loom major Social Security financing gaps. Paying promised benefits will require the government to raise more than $2 trillion in cash over the next eight years and more than $24 trillion to achieve long-run solvency.

This paper presents policy options – some favored by conservatives, others by progressives – as a framework for negotiating a solution. Taken together, the changes could generate more than twice as much in savings and revenue than needed to balance Social Security’s books.

The nation’s biggest banks in effect have become today’s payday lenders.

Which U.S. Households Have Credit Card Debt? – St. Louis Fed

46% of American households held credit card debt in 2022.

– Expand the child tax credit to help more working-class parents and grandparents raising kids.

– Provide Social Security credit for unpaid work raising young children.

– Update/improve SSI so more people with disabilities can work, save.

– If taxes must go up, hold the working poor harmless.

Click here for longer version including references and related articles.

CCSE work contributes to Congressional hearing on financing Social Security

Center on Capital & Social Equity (CCSE) analysis and advocacy were evidenced during the June 4 House Ways & Means subcommittee on Social Security hearing of the program’s trust fund. Over the past years, CCSE has worked to explore issues affecting low-wage workers and lay groundwork to defend their Social Security benefits when Congress eventually refinances the nation’s most important social program.

It’s Social Security ‘groundhog day’ as trustees repeat annual forecast of declining finances

“…The trustees’ report, however, neglects to mention how Social Security already is impacting the overall federal budget. As pointed out to the Senate Budget Committee, the mechanics of spending down Social Security’s reserves require the Treasury to draw funds from general revenue and issue new debt to the public. As a result, Social Security is gradually and organically moving to paying for current benefits through debt substituting for now-insufficient payroll taxes that it traditionally relies on.”

Missing the obvious: life expectancy in the U.S. is closely related to income – Karl Polzer

“The underlying theory is simple: More income and wealth allow people and governments to support more years of life. Fewer resources put them at a disadvantage. Some politicians who see the connection may be leery of talking about it. Doing so would lead to awkward questions about improving working and living conditions for millions of Americans and dealing with growing economic inequality.

“The strong relationship between income and longevity is clear when comparing states… (E)ight of the nine states with the lowest median household income also are among the bottom nine in longevity. Similar clustering occurs comparing the highest ranked states across the two categories. Seven of the nine states with the highest median household income also are among the top nine in life expectancy.

“Realizing they are rowing in the same economic boat could prompt states to join forces on policy changes, particularly Mississippi, West Virginia, Louisiana, Arkansas, Alabama, New Mexico, Kentucky, Oklahoma, South Carolina, and Tennessee, and others ranking at or near the bottom…

“Presidential candidate and former South Carolina Governor Nikki Haley strongly proposes raising the program’s retirement age on the premise that increased life spans are undermining Social Security’s long-term solvency. If long-held assumptions about longevity were challenged, and potential losses to low-income workers and low-income states caused by raising the eligibility age came to light, would she change her position? Republican candidate Donald Trump, by the way, opposes cuts in Social Security as do most Democrats…”

Thanks to the Washington Examiner for running this op-ed:

Senate minimum wage bills make bipartisan compromise possible – Washington Examiner

For longer version with references, see:

Previous work on this issue:

One way to make living easier in Virginia – letter to WaPost

Yes, raise the minimum wage, but don’t stop there – op-ed

“More Americans are rightly asking if Israel could neutralize Hamas without massive destruction and loss of civilian life. Indiscriminate air attacks by the Netanyahu regime already have killed and injured tens of thousands of Gazans with no end to the violence in sight. To put this in perspective, imagine how Washington, D.C., would look if a foreign government with the power to fence in the District of Columbia dropped a comparable number of bombs here while shutting off access to water and food and destroying most of the capital area’s housing and medical system. UN officials say conditions in Gaza are catastrophic.”

Thanks to the Washington Post for publishing our letter to the editor:

One way to make living easier in Virginia – Karl Polzer/letter to WaPost

“Virginia Gov. Glenn Youngkin (R) told reporters he is ‘concerned about the cost of living in Virginia and we’re continuing to evaluate how best to address that,’ as reported in the Nov. 26 Metro article ‘Budget battle looms in Virginia. Facing a tighter fiscal environment and Democratic control of the legislature, Mr. Youngkin and fellow Republicans could help working families without denting the budget by making an expected Democratic push for a higher minimum wage a bipartisan affair.

“The GOP has been trying to attract more minority and working-class voters. However, party leaders have stopped short of addressing core economic issues, such as supporting higher wages and better benefits, and mainly stress cultural issues…”

Background Information on these issues provided to Virginia legislators

McCarthy & Co. offer themselves up on the cross to help motivate lazy poor people back to work

Work requirements are a policy failure: Why are they still an option? – The Hill

Thanks to the Washington Post for running our letter:

“Letting Americans Down”

“How can House Speaker Kevin McCarthy (R-Calif.), President Biden and Senate leaders claim to represent the working class and poor when Medicaid work requirements are a focal point in the debt ceiling standoff and the Trump-era tax cuts are not? According to the Congressional Budget Office, the work requirements in the Limit, Save, Grow Act would have a tiny impact (about $5.6 billion in fiscal 2025) on the nation’s $31.4 trillion national debt, but they would increase the number of uninsured and state costs and have no effect on hours worked by Medicaid recipients.

“In contrast, ending the Trump-era tax cuts, which disproportionately benefit the wealthy, could put a major dent in the national debt….”

Because most of this site’s readers won’t be able to get through the newspaper’s pay gate, here’s the draft of the letter sent to the Post:

Debt ceiling negotiators focus on a ‘speck’ in benefits for the poor, ignore the ‘logs’ in their own eyes.

“Legislative Choices for Paying Promised Social Security Benefits”

Statement of Karl Polzer, Center on Capital & Social Equity,

U.S. Senate Budget Committee hearing: “Protecting Social

Security for All: Making the Wealthy Pay Their Fair Share”

Has DT crossed the line into delirium tremens?

“It came out of his mouth during a campaign speech last month.”